Why Build an Ad Network, and Why Now? The Uber Example

As we gear up for AdWeek New York 2024, let’s dive into the topic of Ad Networks, which will fuel conversations alongside the usual suspects: privacy, CTV, attention, and of course, AI.

A retail media network is an asset owned and operated by a retailer that publishes advertisements, or a third-party publisher that contains ads that leverage a retailer’s first-party shopper data. Retail media networks may include websites, mobile apps, streaming services, email channels, stores, or partner assets like social networks and digital billboards.

Everybody is Becoming an Ad Network

The advertising industry is massive, and, while data has always been its lifeblood, recent tech changes and privacy regulations have created a new dynamic.

First- and second-party data are now more valuable than ever, while third-party data—although still in play—is steadily losing its power and relevance.

The retail industry was the first to realize that its wealth of first-party data could be turned into a new revenue stream. Traditionally, retail operates on large scales but with razor-thin profit margins. According to BCG, however, a retail ad network can deliver profit margins as high as 90%!

No wonder it’s been years since Walmart started to capitalize its vast data with Walmart Connect.

The frenzy to build ad networks has moved well beyond retail. We’ve seen companies across various sectors jump on the bandwagon:

Retail: Costco, Walmart, Target, Nordstrom, Macy’s, Kohl’s, Wayfair

Commerce: Ebay, Etsy, Shopify

Groceries: Kroger, Albertsons, Walgreens, CVS, 7-eleven

Services: Uber, Doordash, Instacart, Gopuff

And more: Home Depot, Expedia, Mastercard, Klarna, Marriott

Uber Advertising Driving New Revenue

One of the most fascinating examples is undoubtedly Uber. The ride-hailing company, which transformed how we commute, made headlines with its IPO on May 10, 2019. One of the most anticipated listings of the year. Uber priced its IPO at $45 per share, valuing the company at over $80 billion.

But since its debut, Uber has been on a rollercoaster ride—facing pressures in major cities and struggling to turn a profit. The stock saw a post-pandemic surge but soon tumbled back to below 50% of its initial IPO value.

Enter October 2022, when Uber launched its very own advertising network. This time, the growth potential and business sustainability is real.

Uber’s traditional ride-share business continues to generate a massive volume of high-quality data and offers unique opportunities to monetize it through ads—whether placed in the app or even displayed within drivers’ cars. Suddenly, every Uber ride could double as a billboard on wheels!

Ad Networks Won’t Be Easy Money

Just because the opportunity is lucrative doesn’t mean it will come without its challenges.

Building, deploying, and running an ad network is a completely different ball game compared to the traditional operations these companies are used to. It will require new talent, new expertise, and new technology. On top of that, these ad networks will need to convince brands to buy into their vision. It’s going to take time to reach maturity and compete for ad dollars against the established “walled gardens”—who have already proven their ability to deliver results for brands, despite their high costs.

🔑 But with spending on ad networks projected to surpass $100 billion in the US by 2027, it’s no wonder so many companies are eager to embark on this journey monetize their first-party data.

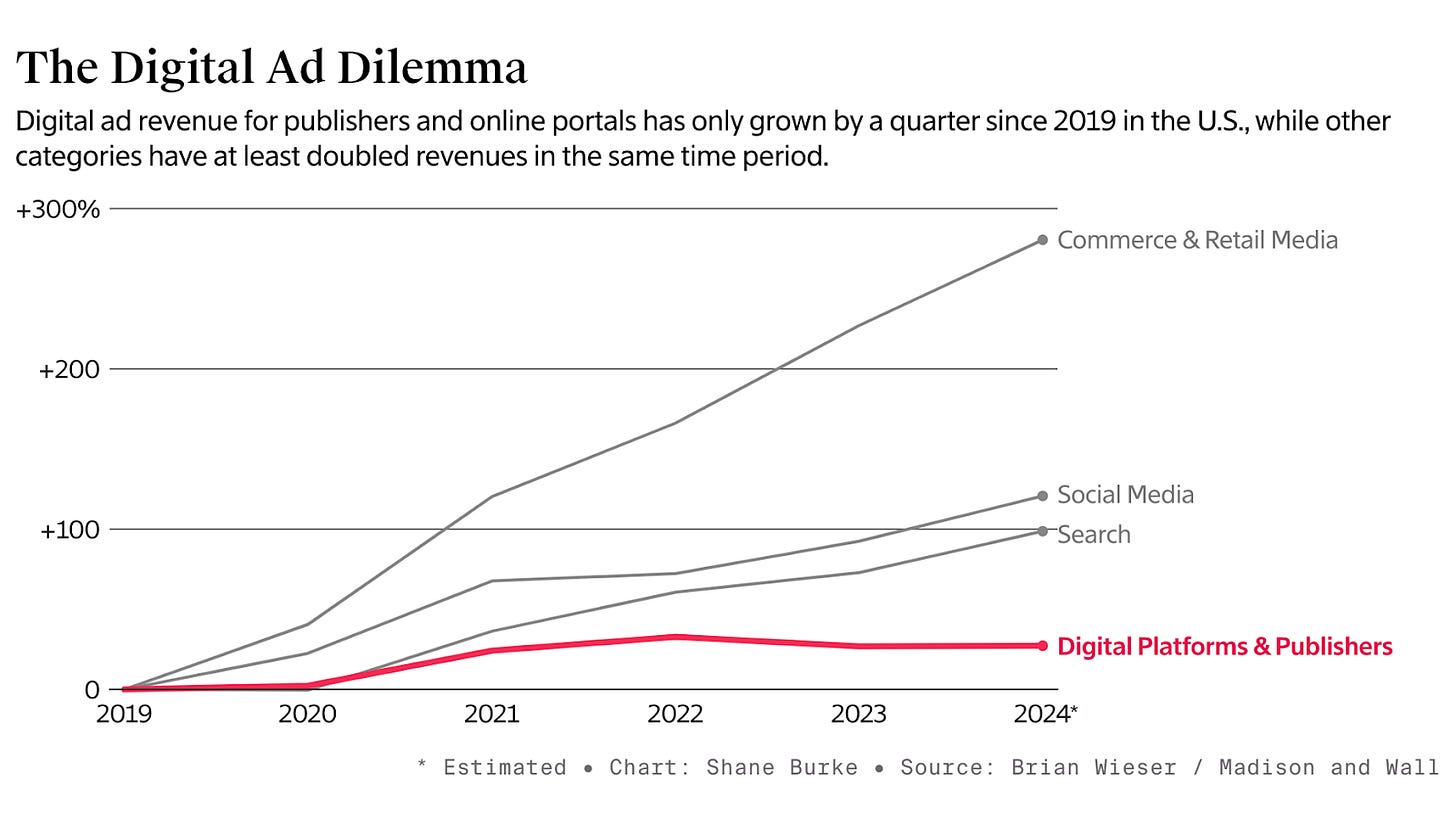

I’ll leave you today with another illustration just published by The Information: